LAKE AND 195 M2 HOUSE + 2D HOUSE TO RENOVATE- NO OVERLOOKING VIEWS

PRICE : 175,000 € inc fees – 195 M2 detached house and lake on a plot of 8,201 m2+ 2d house to renovate + mobile home near the lake

Navigating the complexities of inheritance law in France is a critical endeavor for both nationals and expatriates. The nuanced legalities governing the transfer of assets post-mortem not only underscore the importance of proactive estate planning but also highlight the necessity of grasping the foundational principles that dictate the distribution of one’s legacy.

France’s inheritance law operates within a unique legal framework that is significantly influenced by the Napoleonic Code. This framework establishes a set of predetermined rules regarding the distribution of assets, emphasizing the protection of certain heirs and ensuring that a portion of the deceased’s estate is reserved for direct descendants.

Forced heirship stands as a cornerstone of French inheritance law, guaranteeing that a substantial part of an individual’s estate is bequeathed to their direct descendants. This principle manifests the French legal system’s commitment to safeguarding family interests, ensuring that children and, in some cases, spouses, receive a guaranteed portion of the estate.

The notaire, is a public official responsible for authenticating documents, mediating the estate distribution, and ensuring compliance with French inheritance laws, serving as executor of the will. But it is not always easy to find one of you live overseas and some of them do not speak English. I am here to liaise with the notaire or help you to instruct one.

French inheritance tax rates vary significantly depending on the relationship between the deceased and the beneficiary. Direct descendants and spouses typically enjoy lower tax rates, whereas unrelated beneficiaries may be subject to higher taxation. Understanding these categories is essential for effective estate planning.

Several legal mechanisms, including donations, insurance policies, and the judicious structuring of wills, can significantly mitigate inheritance tax liabilities. These strategies necessitate thorough planning and an intimate understanding of French tax laws.

For those with assets or familial ties across borders, cross-border inheritance can introduce a complex layer of legal considerations. Dual regulations and international treaties may influence the inheritance process, necessitating specialized legal counsel.

European Union regulations, particularly the EU Succession Regulation, affect how inheritance laws are applied among EU member states. These regulations aim to simplify cross-border inheritances, impacting French nationals and residents with assets or beneficiaries in other EU countries.

Inheriting real estate in France is subject to specific legal stipulations. The division of property must adhere to French inheritance laws, which may differ markedly from those in other jurisdictions, particularly concerning forced heirship and tax implications.

The transfer of property ownership through inheritance is a formal process involving the notaire, who ensures that all legal requirements are met. This process includes the verification of titles, calculation of taxes, and the eventual distribution of the property according to the deceased’s wishes or the law.

In the absence of a will, French law dictates the distribution of assets through intestate succession. This legal framework prioritizes direct descendants and surviving spouses, delineating clear rules on how the estate is to be divided among heirs.

Identifying heirs and calculating their respective shares under intestate succession involves a detailed understanding of familial relationships and legal entitlements. The notaire plays a crucial role in this process, ensuring that the estate is distributed equitably in accordance with the law.

French law recognizes several types of wills, each with specific requirements for validity. From holographic wills penned entirely by the testator to formal notarized documents, understanding the nuances of each type is essential for ensuring that one’s final wishes are honored.

For a will to be considered valid and enforceable in France, it must meet certain legal criteria, including clarity of intention, compliance with forced heirship rules, and proper execution. Seeking legal advice can help navigate these requirements, ensuring that the will stands as a true reflection of the testator’s wishes.

Gifts play a strategic role in French inheritance planning, allowing individuals to transfer assets to their heirs during their lifetime. This practice can help reduce the taxable estate and ensure that specific assets are passed to the intended beneficiaries.

Strategic gifting requires careful consideration of tax implications and legal limits

2. French inheritance rights are completely different from its equivalent in Common law countries : take independant legal advice

PRICE : 175,000 € inc fees – 195 M2 detached house and lake on a plot of 8,201 m2+ 2d house to renovate + mobile home near the lake

Compulsory surveys in France are essential, safeguarding property transactions by assessing conditions and risks. They protect buyers, ensuring informed decisions through a legal framework that mandates their execution, covering energy, safety, and environmental assessments.

inheritance rights in France. Be sure you are making the right choice.

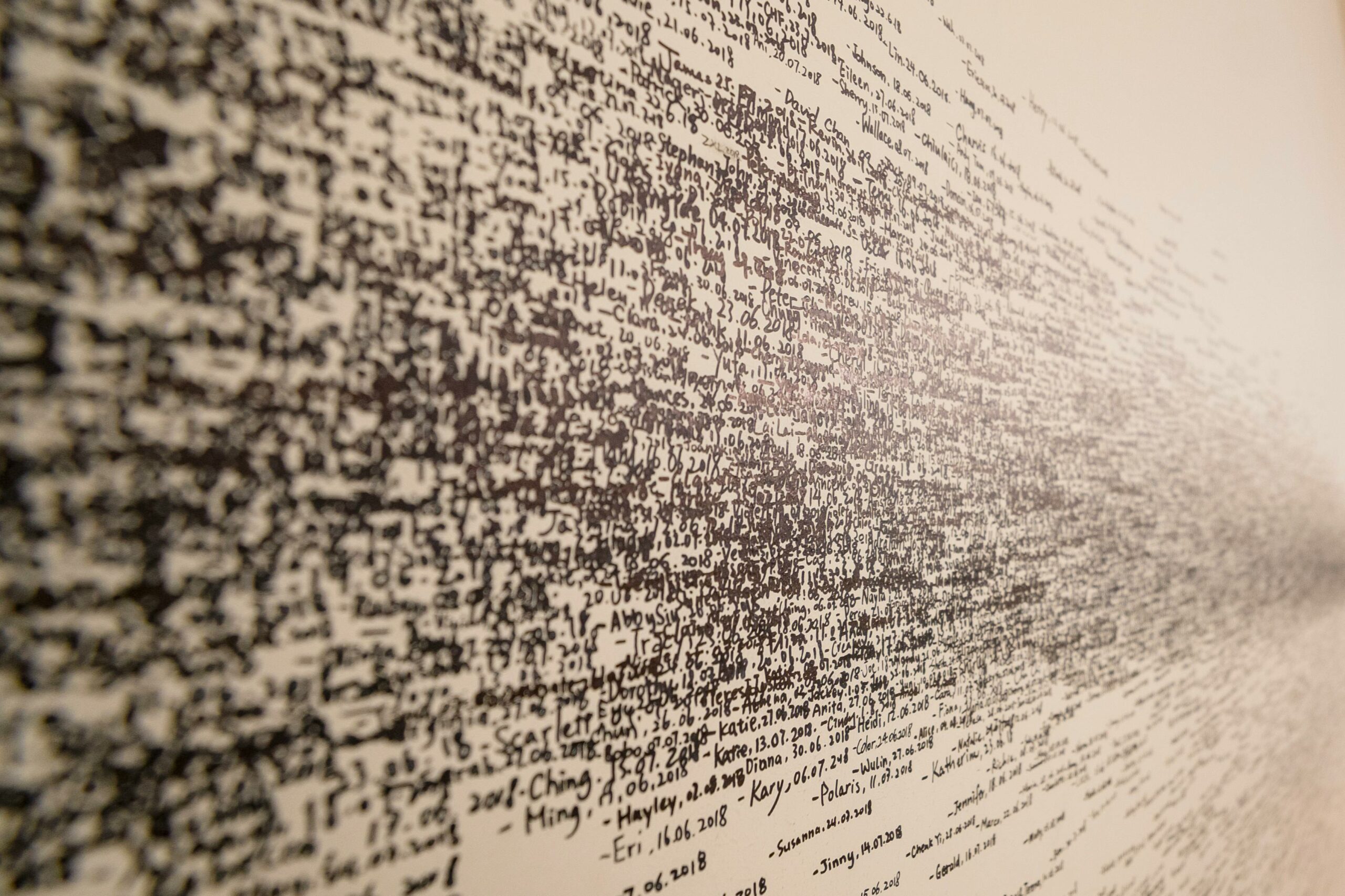

useful words about inheritance

In France, this obligation for property sales came into effect on November 1, 2006, aligning with European Union Directive 2002/91/EC concerning the energy performance of buildings.